May 23, 2019—Spurred by the 2016 Kigali Amendment to the Montreal Protocol on Substances that Deplete the Ozone Layer, the refrigeration and air-conditioning industries are developing innovative approaches to reduce potent emissions from hydrofluorocarbon (HFC) refrigerants and improve energy efficiency. In the coming years, the air-conditioning industry is projected to grow significantly, particularly in developing regions. As demand for room air conditioners grows, so does the demand for the compressors, a key component of these systems.

In their new Clean Energy Manufacturing Analysis Center (CEMAC) technical report,

Mapping the Supply Chain for Room Air Conditioning Compressors, NREL researchers Scott Nicholson and Chuck Booten analyzed the global market for air-conditioning compressors. The report provides a snapshot of the industry and lays out opportunities and challenges for the adoption of higher-efficiency compressors that use low-global-warming-potential (GWP) refrigerants.

Rotary Compressors 101

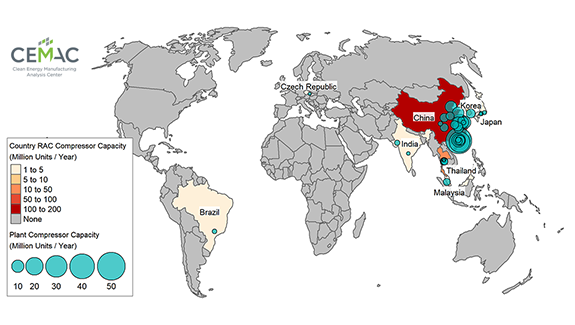

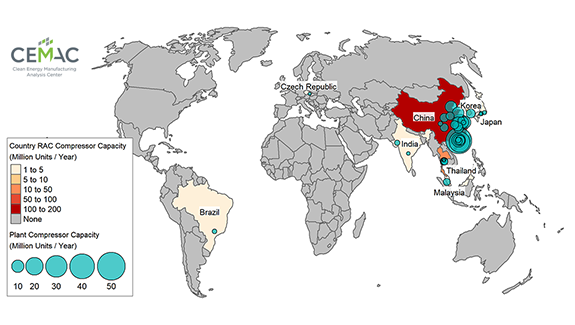

Illustration of a global map depicting room air conditioner compressor capacity in million units per year and plant compressor capacity in million units per year. The map highlights Brazil, Czech Republic, India, China, Malaysia, Thailand, Korea, and Japan.

Figure 1 - Global RAC rotary compressor capacity, estimated as of September 2018

Researchers focused on the market for rotary compressors because they are used in ductless mini-split air conditioners, one of the most popular models of residential air conditioners worldwide. Rotary compressors are offered in either fixed-speed or variable-speed varieties. Fixed-speed units have a simpler control method than that of variable-speed compressors, but this method is less efficient. Variable-speed compressors, on the other hand, are quieter and generally more efficient to operate—but can be more expensive to manufacture, due to their more complicated electronic control system. First developed by Toshiba in the 1980s, inverter-driven compressors have steadily grown in popularity, with patent application filings related to this technology reaching an all-time high in 2016.

In addition to the operational efficiency of the units, emissions are also a chief industry concern. Researchers discuss how compressor lubricants are an important aspect of the air conditioner supply chain's transition to using low-GWP refrigerants. For example, lubricant oils that were developed for use in compressors with earlier generations of HFCs were incompatible with R-32, a low-GWP refrigerant. In recent years, R-32-compatible oil formulations have been developed and patented for room air conditioners.

A Snapshot of Global Compressor Production

Nearly all rotary compressors are produced in Asia—and mostly in China. In fact, four companies within China account for approximately 60% of global rotary compressor production capacity. By consulting company catalogs and websites, researchers discovered that most of the rotary compressor models available in the market today use higher-GWP refrigerants such as R-410A. The fraction of variable-speed rotary compressors versus fixed-speed has grown steadily over the past five years, reaching about 43% of Chinese sales in 2018.

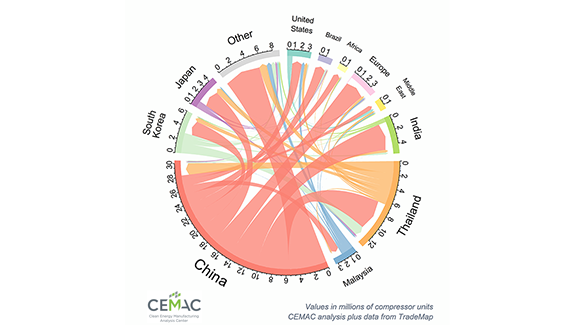

Figure 2 - 2017 Global RAC compressor trade flow, in millions of units

Illustration depicting the global trade flows of room air conditioners in millions of units in 2017. Countries/regions listed are South Korea, Japan, Other, United States, Brazil, Africa, Europe, Middle East, India, Thailand, Malaysia, and China.

Analysis of global trade data revealed that China accounts for most of global rotary compressor trade flows. That said, about 80% of the compressors produced in China are not for export, but rather domestic use for air conditioner manufacture (and subsequent export or sale to consumers within China). Chinese production of both compressors and air-conditioner units rely on imported parts. Variable-speed units, for example, require electronic components from South Korea, Japan, and (to a lesser extent) the United States. For this reason, some companies are looking to develop capacity to produce these inputs at their own plants in order to reduce reliance on imported parts.

In India, growing demand for residential air conditioners has precipitated the rise of domestic air-conditioner compressor manufacturing in that country. According to industry contacts there, the Government of India's Bureau of Energy Efficiency air conditioner efficiency ratings are an important factor driving industry research and development. Manufacturers are especially focused on the production of models within the "3-Star" intermediate-efficiency classification, which includes both fixed-speed and variable-speed models. Depending on the costs of compressors, electronic controls, and other components, companies may opt to either improve the efficiency of fixed-speed models or develop new variable-speed models for the 3-Star efficiency category.

In Brazil, the Basic Productive Process policy plays an important role in shaping compressor and air-conditioner production. This policy offers tax incentives to companies that manufacture products using a certain percentage of in-country-sourced parts. For this reason, most manufacturers of room air-conditioning units source their parts from Brazil's lone local compressor manufacturer, Tecumseh. Tecumseh produces fixed-speed models that use higher-GWP refrigerant.

Looking to a More Efficient Future

With support from the Multilateral Fund for the Implementation of the Montreal Protocol, several countries, including China, Indonesia, Thailand, and Vietnam, have implemented programs to encourage the adoption of low-GWP refrigerants in air-conditioning manufacturing. These projects have each had their share of successes as well as challenges, which stem from a number of factors including updating building flammability codes, public awareness, and availability of higher-capacity, low-GWP refrigerant compressors.

The end goal of this CEMAC report is to inform the discussion around efforts to transition the global residential air conditioning sector toward more energy-efficient cooling equipment utilizing lower-GWP refrigerants.